Energy-to-Value: a pricing model for Bitcoin

Introduction

The question of the future price of Bitcoin has given rise to numerous models. Among the best known are PlanB's "stock-to-flow" model, which is based on relative scarcity, and Giovanni Santostasi's "power-law" model, which describes long-term price movements in logarithmic scaling.

Both models offer interesting insights and are based on concepts such as relative scarcity and the adjustment of price curves using linear regression.

A combined valuation approach

Energy use and subjective marginal utility as price model elements (Energy-to-Value, E2V)

This article takes a different approach: it combines the physical-energetic principles of the Bitcoin protocol - in particular the use of energy in mining - with the economic theory of the subjective theory of value.

The aim is to formulate a logically consistent price structure that covers both:

-

the objective cost components (e.g. power consumption, halvings, hashrate)

-

as well as the subjective benefit perception of market participants

This results in a dynamic price band that shifts along an economic axis of tension between production costs and the perception of marginal utility.

Structure of the article

-

The mathematically determinable lower price limit

-

Pricing in Subjective Value Theory

-

The Bitcoin price model (E2V) as a combination

-

Clarifications on energy backing and common misunderstandings in pricing

1. The mathematically predetermined price floor of Bitcoin in the context of value production through proof-of-work

Basic principle of the price floor

If the production costs of a good are not covered by the market price, this good disappears from the market. This fundamental economic principle also forms the basis for determining the price floor for Bitcoin. This analysis is based on the assumption that Bitcoin will continue to exist in the long term and will not disappear from the market permanently.

Production costs of Bitcoin

The production costs of Bitcoin result from measurable factors such as:

-

-

- Power consumption

- Hardware amortization (ASIC machines)

- Operating costs (cooling, maintenance, personnel, location)

-

These factors determine the minimum price required to operate mining economically.

Bitcoin halving and production costs

The halving mechanism reduces the emission of new bitcoins every 210,000 blocks (~4 years):

-

-

- Originally 50 BTC per block

- Then 25, 12.5, 6.25, currently 3.125 (since 2024)

- Then approx. 0.0006123 Bitcoin per year in 2136

-

Halving doubles the production costs per Bitcoin, provided that other influencing factors (in particular energy price and hardware efficiency) remain constant. This forces a regular increase in the minimum market price in order to keep mining profitable and ensure the security of the network.

The last Bitcoin is mined in 2140. From this point onwards, miners will only receive transaction fees - paid out in Bitcoin or Satoshis - as remuneration for their work. For the Bitcoin network to continue to function, these fees must then be high enough to cover the miners' operating costs in full. If the market value of Bitcoin does not cover these fees, miners would shut down their equipment, which could lead to the Bitcoin network ceasing to operate.

If financed exclusively by transaction fees, the Bitcoin price is likely to stabilize at a high level. A largely constant number of professional, highly specialized miners will establish themselves, continuously generating a stable return as part of a low-margin model. It remains to be seen when exactly this plateau will be reached.

Role of the hashrate in price formation

The hashrate describes the total computing power of the Bitcoin network and significantly influences the required production costs:

-

-

- An increasing hashrate increases the difficulty and thus the required energy and hardware input.

- On the other hand, if the Bitcoin price falls below the production costs, miners reduce their computing power, which in turn lowers the difficulty and reduces the production costs per Bitcoin.

-

The pricing of Bitcoin therefore takes place in a field of tension:

-

-

- If the Bitcoin price is below the production costs, it is more worthwhile to buy Bitcoins directly on the market instead of mining them yourself. At the same time, the difficulty is reduced.

- However, if the price is higher than the production costs, mining becomes profitable, which draws new computing power into the network. At the same time, the difficulty is increased.

-

This creates a dynamic balance between mining activities (hashrate) and market demand from buyers.

The hashrate thus indirectly reflects the confidence in Bitcoin as a long-term store of value and signals an objective price floor as well as the relative attractiveness of Bitcoin mining compared to the direct purchase of Bitcoin.

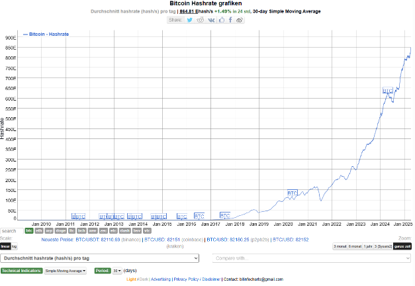

Actual measured average Bitcoin hashrate (30-day average) until January 2025

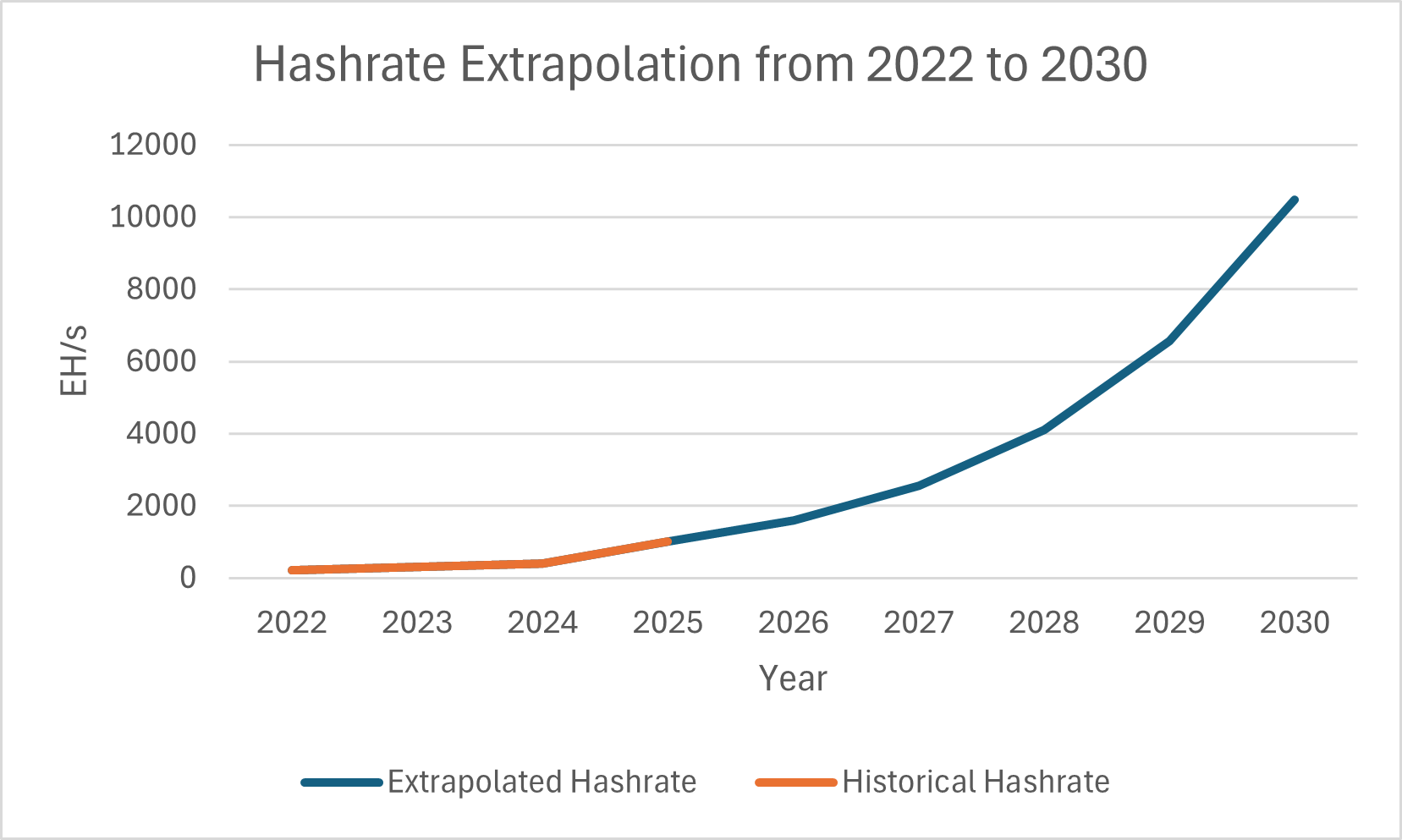

The historically observable hashrate shown in orange in the chart extends to the year 2025, on the basis of which the future hashrate (blue) is extrapolated to 2030.

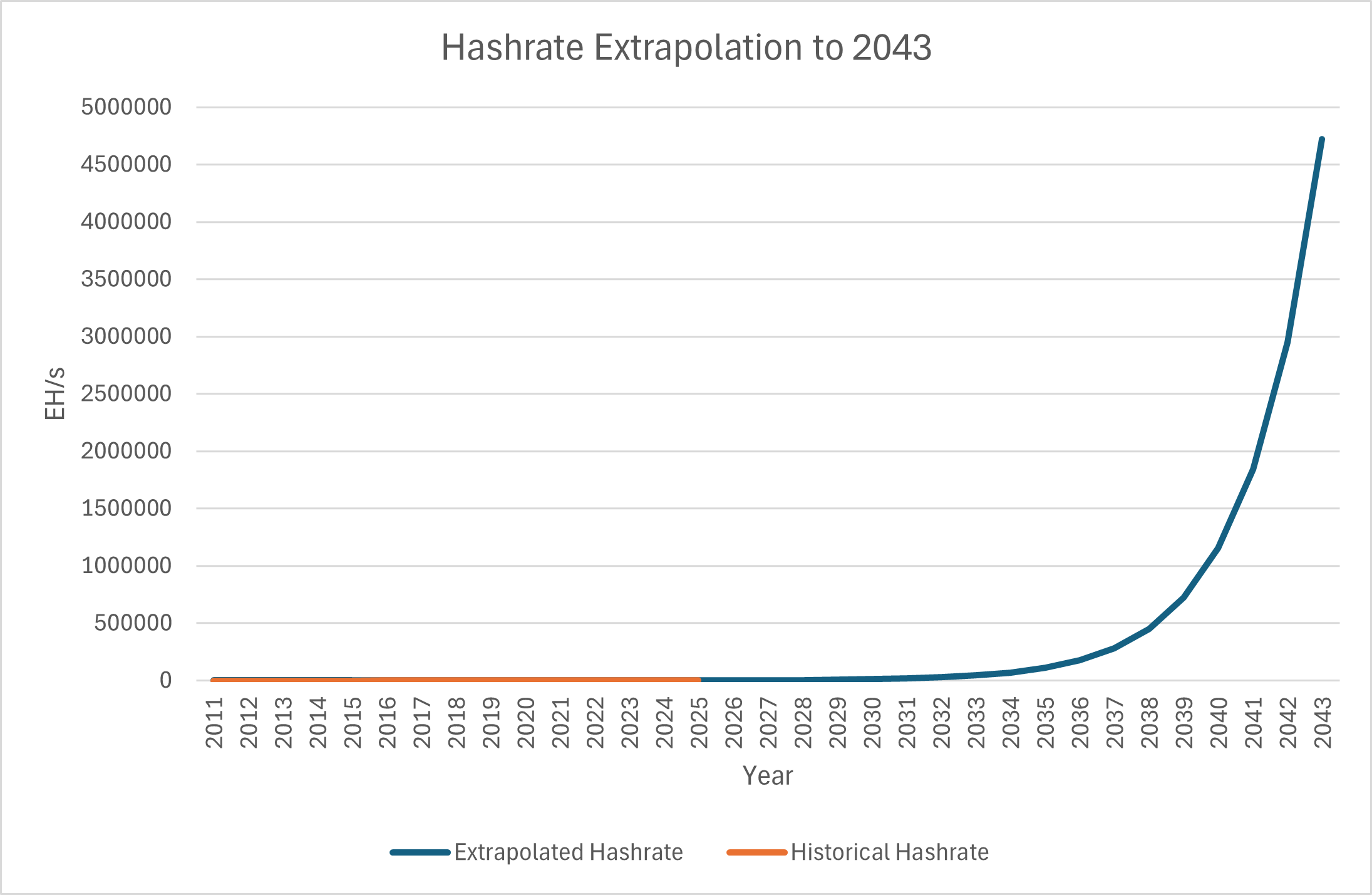

The chart shows a long-term extrapolation of the Bitcoin hashrate up to the year 2043. While the global adoption of Bitcoin and the associated mining capacity can be forecast with a relatively high degree of certainty for short-term periods, the long-term development is more speculative. External influencing factors are difficult to predict in the long term. Nevertheless, the trend shown provides a plausible direction.

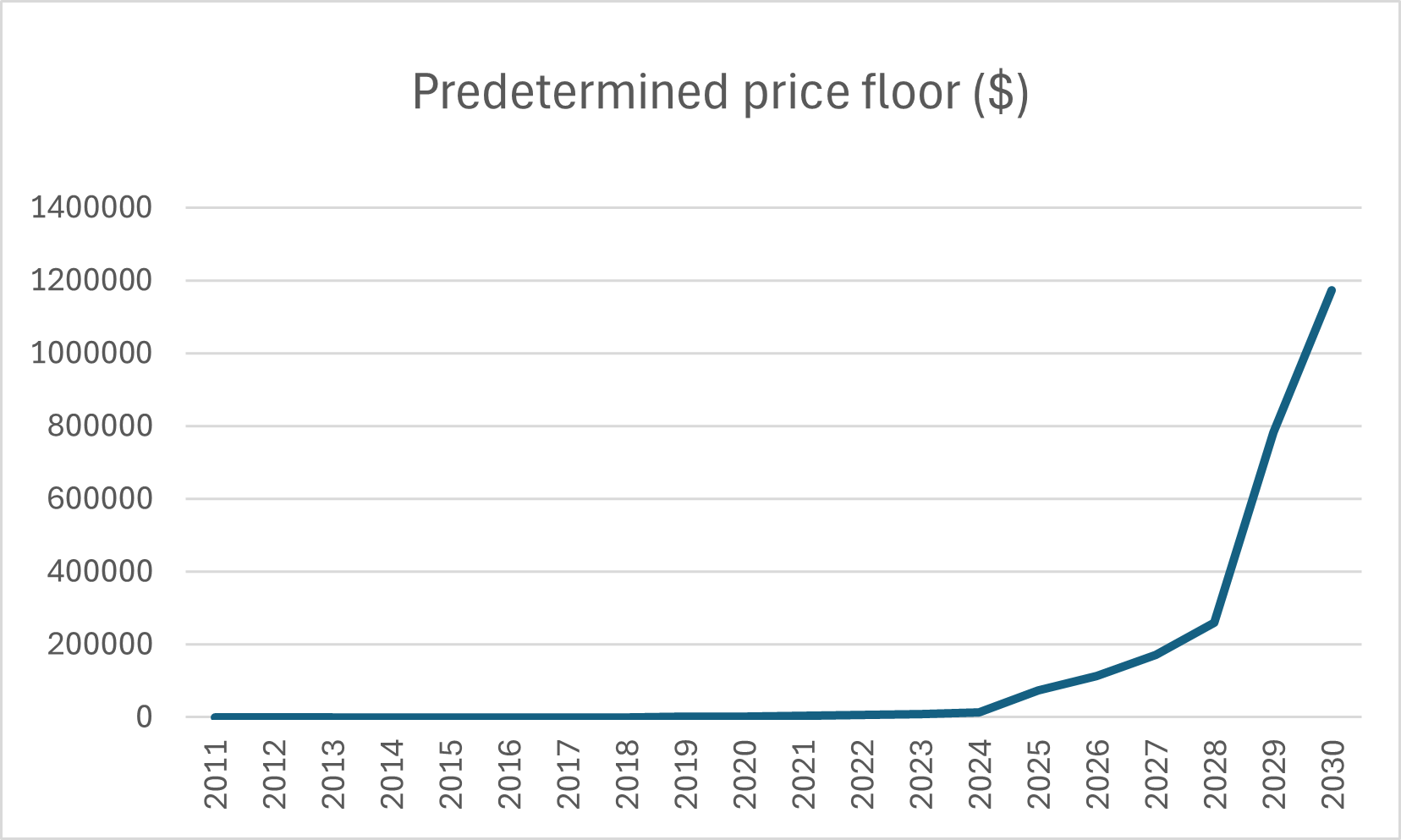

Calculation and forecast of the Bitcoin price

The lower price limit of Bitcoin can therefore be represented as a minimum price curve, defined by production costs (including hashrate) and the continual reduction in the issuance of new Bitcoin (capped at 21 million BTC by 2140). Technological innovations and efficiency gains can dynamically influence this curve.

The objective price floor can still be approximated today by estimating the average daily production costs per Bitcoin. As electricity prices, hardware efficiency and location conditions vary greatly around the world, this estimate is based on model-based assumptions - it nevertheless represents a reliable approximation based on real economic parameters.

The actual market price is usually above this production cost curve and is explained by the classic supply-demand dynamic (see next chapter).

This view offers a clear and robust explanation of the pricing of Bitcoin and emphasizes the crucial importance of objectively measurable production costs.

The lower price limit shown is based on modeled production cost assumptions and defines the economically sound lower limit of the Bitcoin price until 2030.

Influence of hashrate and halving on the price floor

The objective lower price limit of Bitcoin results from the real economic costs associated with the creation of a new Bitcoin. In an energy- and hardware-intensive proof-of-work system, this value is significantly influenced by the overall hashrate of the network and the applicable block subsidy.

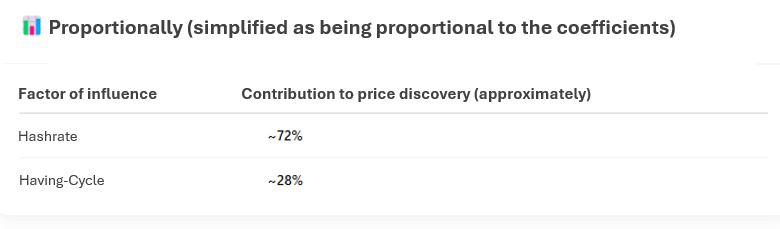

A multiple regression analysis shows that around 72% of the variance in the logarithmic production costs per BTC can be explained by the logarithmic hashrate. This reflects the total energy expenditure of the network and thus acts as a direct measure of the objective equivalent value of a Bitcoin in a thermodynamic sense.

In addition, the halving level, i.e. the number of times the block subsidy has been halved, explains a further 28% of the variance. Although halvings do not cause any direct costs, they lead to a sharp reduction in revenue per miner and force the system into a new energetic equilibrium in the medium term - either through increasing efficiency, a higher BTC market valuation or reduced mining participation. This structural reaction to halving is therefore not linear, but systemic.

To summarize: the hashrate is the main factor for calculating the objective price floor, while the halvings cause its jumps. Both factors are therefore complementary components of an objective value analysis of Bitcoin.

Why a permanently low Difficulty becomes impossible - The profit logic as a driving force for the monetization of the Bitcoin network

The profit motive is central to understanding why Bitcoin cannot continue to exist at a low level of miner activity in the long term. As soon as an imbalance between price and difficulty arises - for example due to falling difficulty with stable demand - the profit margin for individual miners increases. This prospect of above-average profits automatically a) attracts new market participants and b) motivates existing miners to put more ASIC machines into operation. In terms of game theory, this is imperative as long as Bitcoin is perceived as a valuable asset.

Decreasing difficulty = increasing chance of winning blocks

-

If many miners drop out, the difficulty decreases → the remaining miners receive more BTC per kWh.

-

This acts as an automatic stabilization mechanism: profitability is restored, even when prices are low.

Economic logic:

If the difficulty falls but the BTC price does not fall any further, then the margins per miner increase because:

the block reward remains the same (in BTC),

but the energy input per BTC decreases,

i.e.: profit per kWh used increases.

Game-theoretical implication:

-

For miners, the incentive is non-linear: as others become inefficient or exit the network, the marginal profitability of the remaining efficient miners increases disproportionately..

-

The more miners drop out, the greater the incentive for the remaining - and new participants to get back in.

-

The market may be temporarily "thinned out", but will never stagnate permanently at a low level as long as the Bitcoin price is significantly above zero.

The price equilibrium after 2140

If we assume that Bitcoin will continue to exist in the long term, the equilibrium price must be significantly higher than today, as miners will be financed exclusively by the few Satoshis from the transaction fees per block from 2140 onwards. At a high Bitcoin price, these fees must generate sufficient profit for a large number of global miners who are constantly competing for these scarce revenues in an open, unrestricted market. A permanently low mining level is hardly sustainable in a globally open market with free access.

→ The price will inevitably have to be exorbitantly high in order to maintain Bitcoin's incentive structure in the long term.

2. The subjective theory of value (marginal utility theory) and flexible demand above the objective price floor

Basic idea

The subjective theory of value assumes that the value of a good arises from the benefit that an individual subjectively ascribes to it. The value is therefore not in the good itself, but results from the assessment of the demander.

The concept of marginal utility is central to this: the additional benefit provided by an additional unit of a good generally decreases as the quantity increases. This decreasing marginal utility largely determines the willingness to pay on the demand side.

In conjunction with the supply side, this results in a market price that is set at the intersection of subjectively perceived willingness to pay (demand) and quantity ready for sale (supply).

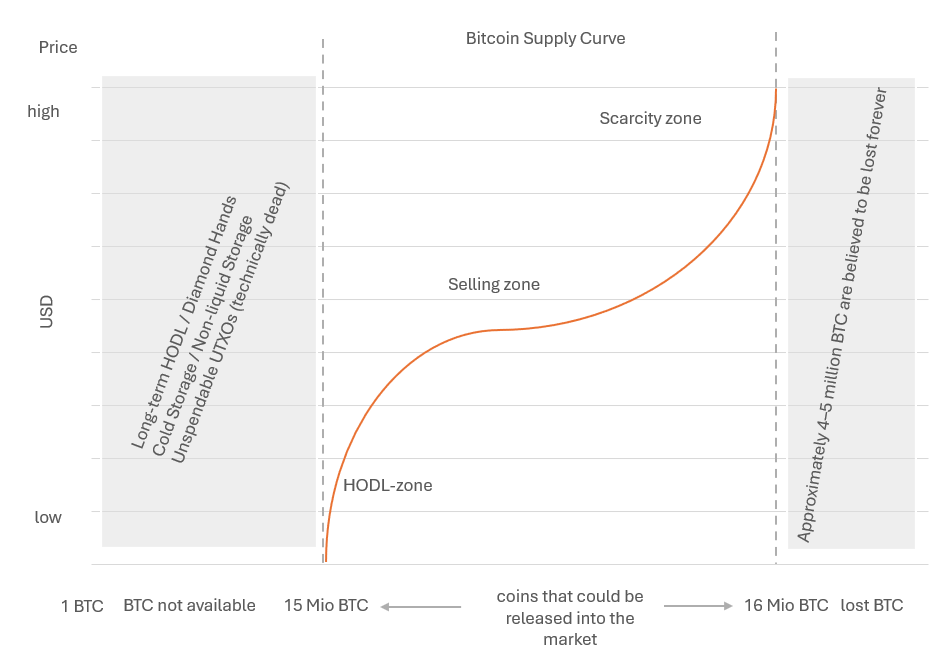

The Bitcoin Supply Curve

The Bitcoin Supply Curve

The supply curve depicted shows at what price how many Bitcoin could realistically come onto the market. It is not linear, but is shaped by psychological and structural factors - and therefore takes the form of a mirrored, horizontal S:

-

HODL zone: At low prices, the willingness to sell is extremely low - only a few BTC reach the market.

-

Selling zone: As prices rise, the willingness to liquidate parts of the portfolio increases. This is where most of the market activity typically takes place.

-

Scarcity zone: At high prices, supply remains limited, as many BTC are held long-term or are not sold out of conviction ("diamond hands").

To the left of the curve are BTC that cannot be mobilized for technical or psychological reasons. To the right are lost coins that have been permanently removed from the market. Both limit the effectively available supply.

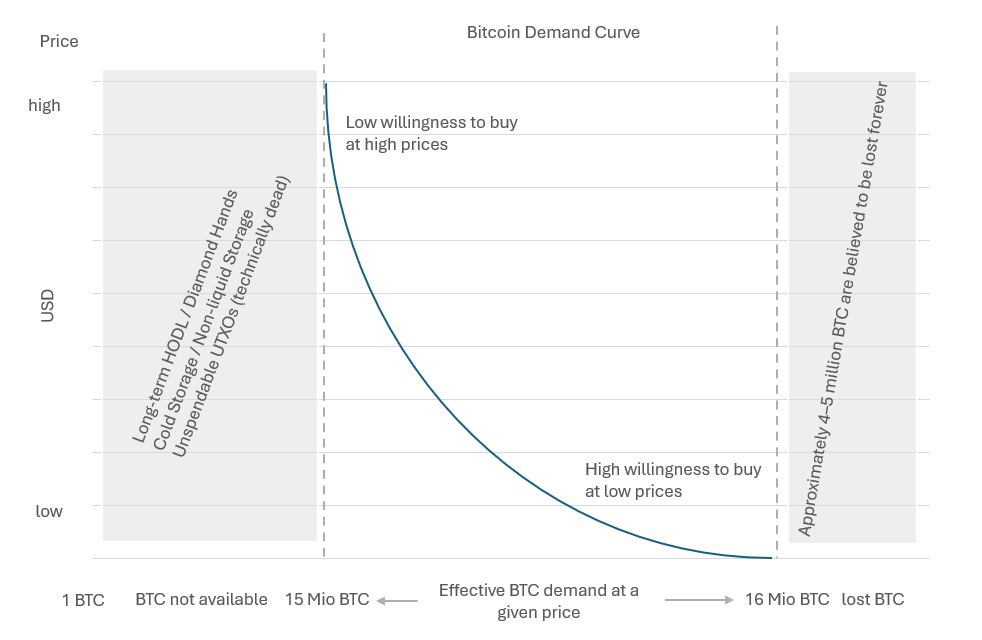

The Bitcoin Demand Curve

The demand curve shows how many Bitcoin are actually in demand at a certain price - i.e. how many units market participants are willing to buy. It typically runs falling as the willingness to pay decreases with rising prices.

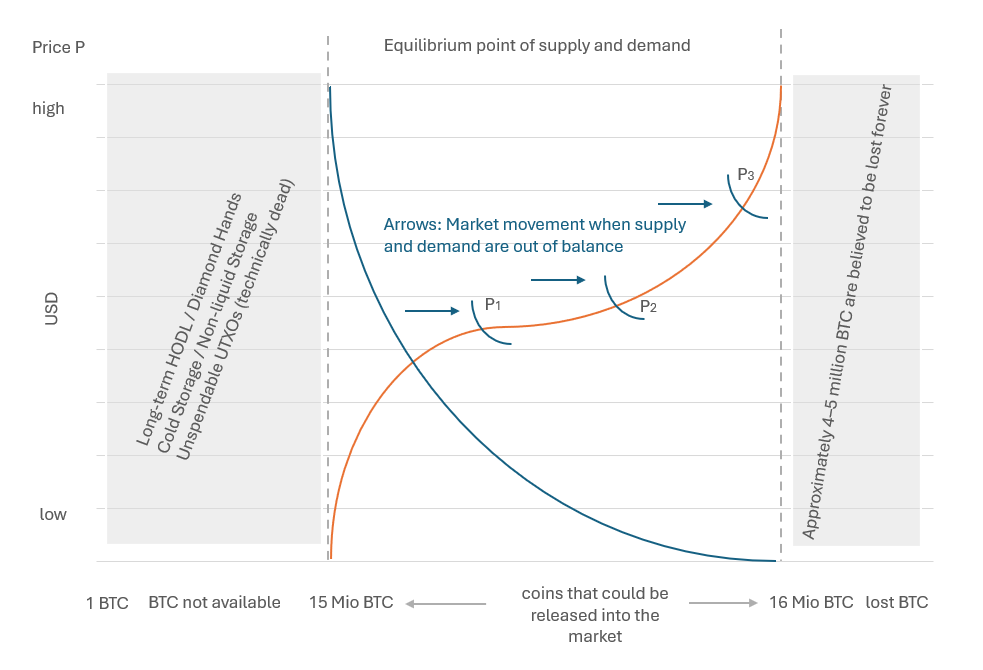

Price formation through supply and demand

The subjective theory of value is the basis of the market price model, in which the price is formed at the intersection of supply and demand.

- Supply = available quantity of a good

- Demand = willingness to pay on the basis of subjectively perceived benefit

- Market price P = point at which both curves intersect

The graph shows how a price is formed in the Bitcoin market from the interplay of supply and demand. The intersection of the two curves determines the market price - i.e. the price at which the supply and demand of BTC match.

The orange Supply Curve is rising:

→ The higher the price, the more market participants are willing to sell their BTC.

Psychological thresholds (e.g. in the sell zone or scarcity zone) and technical limitations (cold storage, lost coins) play an important role here.

The blue Demand Curve is downward sloping:

→ The lower the price, the more BTC buyers want to purchase.

This behavior follows the subjective theory of value, according to which the willingness to pay increases at low prices, but decreases sharply with higher prices.

Dynamics in case of imbalance:

If there is an imbalance between price and demand, the market adjusts automatically: The price moves from P₁ via P₂ to a new equilibrium - exemplified by the blue arrows in the graph.

Special feature of Bitcoin:

-

The X-axis only shows the part of the Bitcoin supply that can actually be mobilized - approximately between 15 and 16 million BTC (= 1 million actually tradable BTCs). Coins outside this range are either technically lost or are in long-term custody with no intention of selling.

-

This results in pricing that takes place above the objective production costs (lower price limit), but is strongly influenced by the subjective willingness to pay of market participants.

The subjective theory of value presupposes an existing market. The good must therefore have already been produced - which is only possible if the seller expects a price and sells it for at least the price that covers the production costs.

→ It therefore acts above the objective price floor.

3. Bitcoin's price model: between production costs and market psychology

Two economic forces determine the price of Bitcoin: objective production costs as the lower limit and subjective demand as the upper price potential.

This illustration shows by way of example how the market price of Bitcoin is formed within a dynamic price band that is determined by two fundamental mechanisms:

-

The objective lower price floor results from the measurable production costs (in particular the hashrate and the halving effect). It defines the lower range below which a miner can no longer operate profitably in the long term.

-

The subjective demand curve is formed from individual willingness to pay and perception of benefit (marginal utility theory). It explains why the market price is often far higher than the production costs.

→ The interaction of both components creates a price band that shifts dynamically due to market mechanisms - particularly in the event of technological innovations, halvings or changes in market perception.

This model forms the theoretical basis for an economically consistent valuation of Bitcoin as a limited digital good with real economic anchoring.

Historical starting position: Objective price floor vs. market price

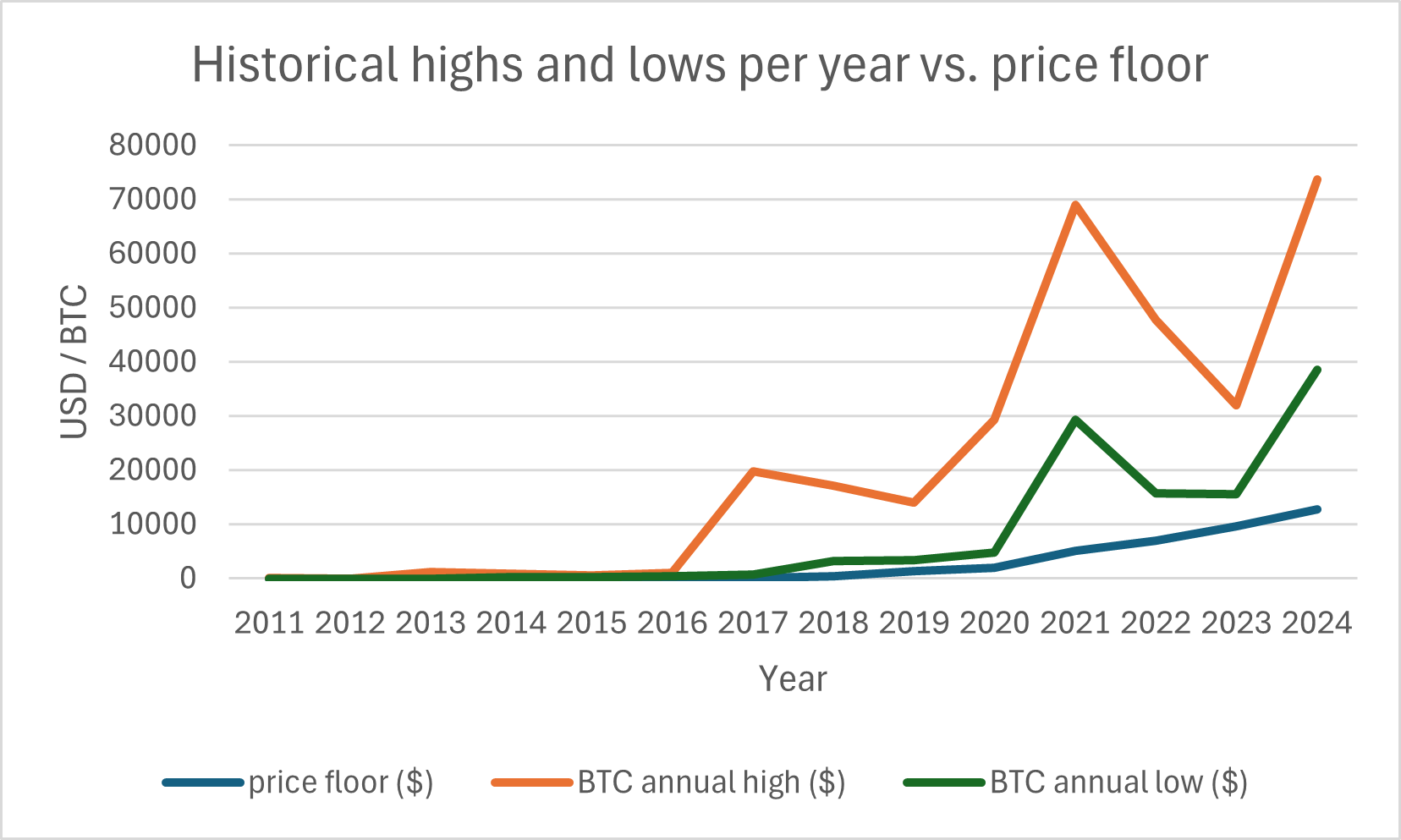

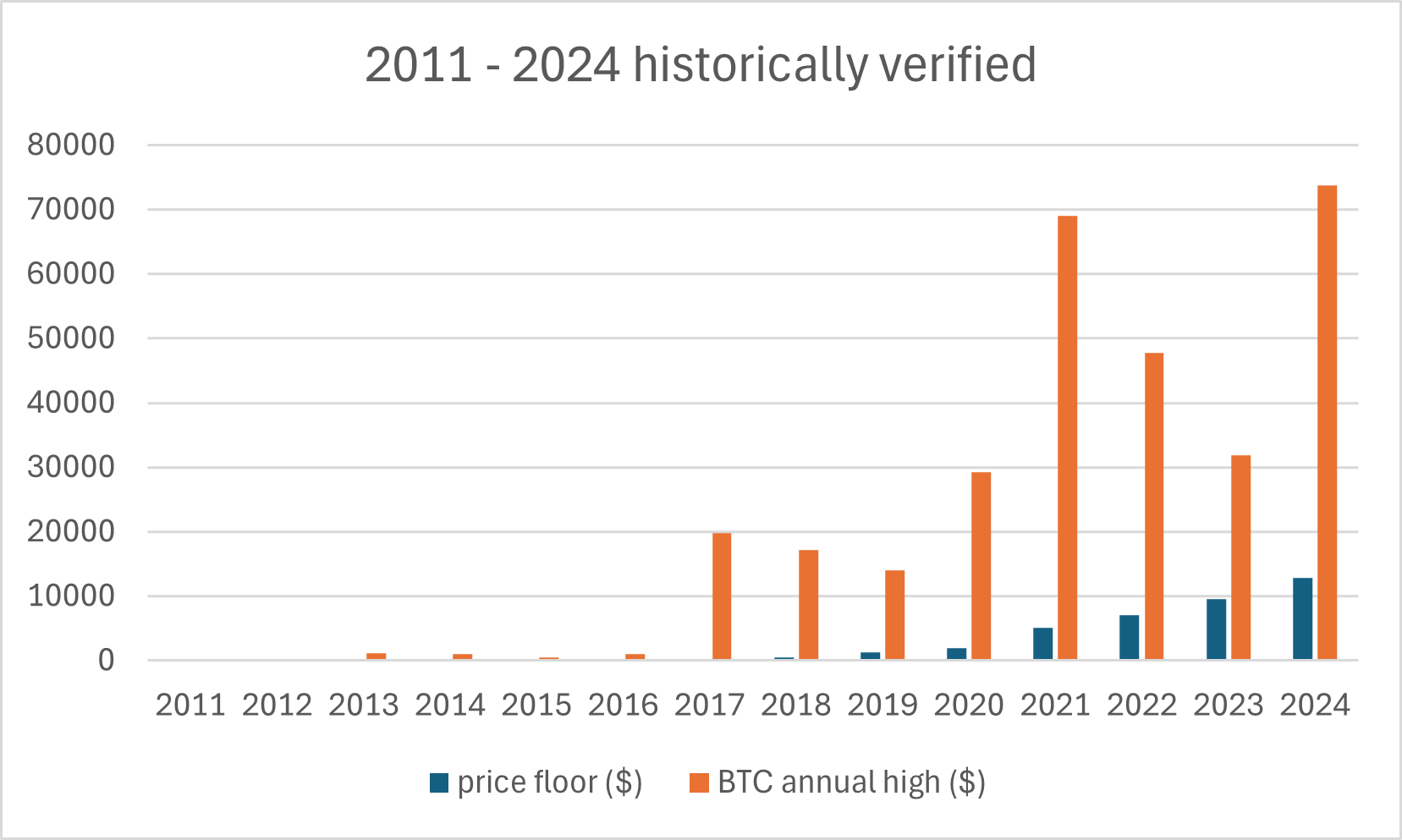

The chart shows the historical course of the annual Bitcoin highs (orange) in comparison to the respective estimated objective price floor (blue), which can be derived from the production costs (hashrate & halvings).

Observation:

-

In all years since 2011, the market price has been well above the objective price floor.

-

The difference is extreme in some cases - especially in the years after the halvings (2013, 2017, 2021).

-

Even during correction phases, the market price never permanently fell below production costs.

→ This empirical evidence supports the thesis that Bitcoin is systematically traded above its objective minimum value.

Importance for the model:

This historical starting point forms the basis for further extrapolation of the lower price limit - and for modeling a dynamic price band within which the market price will move in the long term.

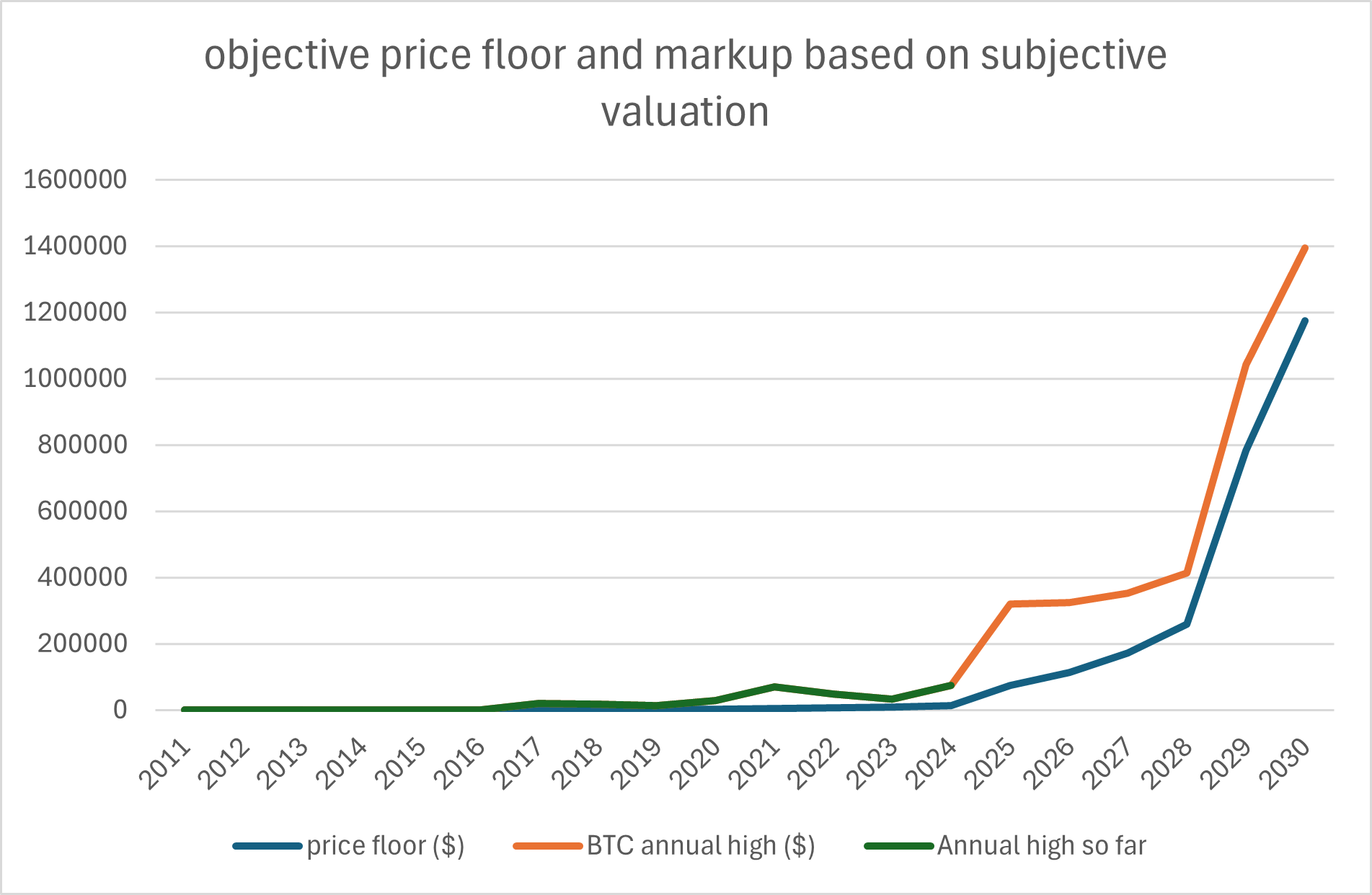

Extrapolation: Objective price floor and subjective mark-up

Based on the observable history and the established relationship between production costs and market price, a realistic price range can be modeled within which Bitcoin is likely to move in the future.

The graphic shows:

-

The blue curve represents the extrapolated lower price limit, derived from the hashrate, halvings and assumed technological progress. It increases exponentially.

-

The orange curve extrapolates the annual high of the market price, based on historical mark-ups above the production cost line.

-

The green curve shows the high for the year to date, which serves as a guide and reflects real market behavior up to the current point in time.

In the energy-to-value model (E2V), not only the price floor but also the subjective price premium is anchored in the energy production process.

The model uses the underlying hashrate and the halvings defined in the protocol to derive a dynamic upper price band.

The actual market price moves within this band - between production costs and perceived marginal benefit.

The resulting price band is neither arbitrary nor speculative, but historically empirical and logically modelable.

The Bitcoin price calculator (E2V Bitcoin Calculator) enables the individual calculation of the lower price limit and the theoretical maximum price

Predictability of the value surcharge

The question arises as to whether and with what certainty the value premium can be predicted by subjective valuation above the production costs.

Since subjective value premiums do not follow physical laws but are based on individual assessments, this correlation can be observed statistically and described empirically – yet it is not governed by any fixed economic law of nature. However, in the Energy-to-Value (E2V) model, it is also anchored and modelled indirectly through the underlying energy requirements.

Political developments, social moods or technological upheavals can strongly influence the valuation of individual market participants. These divergent assessments are reflected in price fluctuations, which are typically triggered by uncertainty and the subjective perception of opportunities.

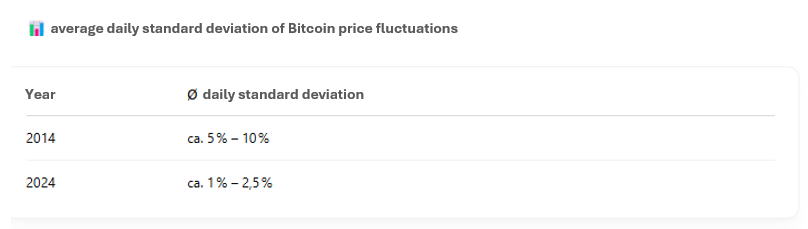

However, such fluctuations primarily occur at the upper end of price formation - where subjective valuation according to marginal utility theory takes effect. Particularly in the early phase of Bitcoin's life, high standard deviations in the market price could be observed - an expression of great uncertainty and strongly diverging subjective assessments. A comparison illustrates this development:

This development corresponds to an average decrease in daily volatility of around 15% per year over the period from 2014 to 2024.

As time goes on and the market matures, the price swings become correspondingly smaller. This development is favored by growing security, higher liquidity and greater institutional participation.

The influence of individual value judgments is gradually receding into the background - relative to the growing importance of objective fundamental data such as the protocol-related properties of the network and the underlying energy costs.

In the long term, it can be assumed that the subjectively driven price component will increasingly level out. As soon as all bitcoins have been mined, the market price may come closer to the mathematically determinable lower price limit resulting from the energy input and the structural properties of the network.

This development can be illustrated as follows: As production costs rise into the millions, a permanently high subjective value premium becomes increasingly unlikely. This is because the more expensive a good already is to produce, the more difficult it is to justify buyers spending the same amount or more on the basis of subjective assessment alone.

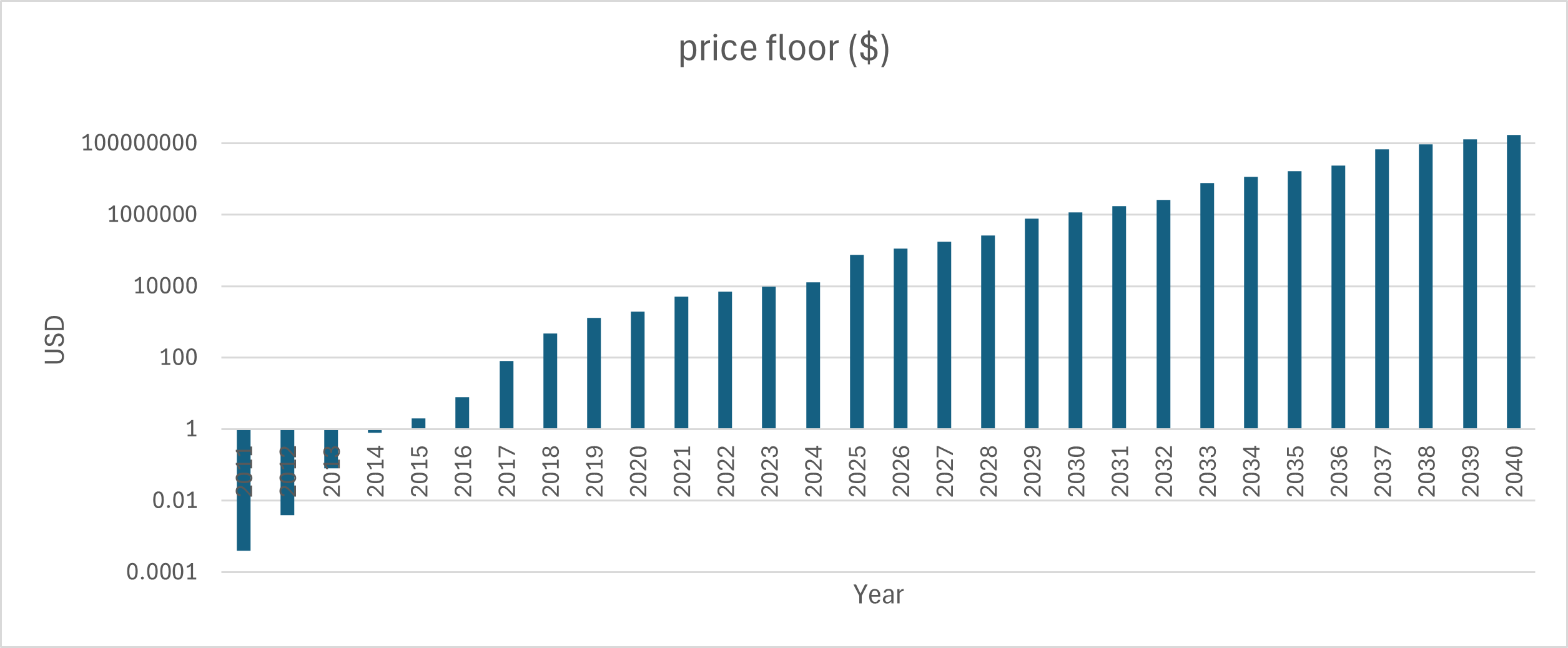

Long-term projection of the objective price floor (logarithmic)

This chart shows a long-term extrapolation of the objective price floor per Bitcoin until 2040 - based on an extrapolation of the previous trend of hashrate, halving dynamics and energy-economic structure.

As the Bitcoin production mechanism is algorithmically fixed until 2140, the underlying logic can theoretically be extrapolated far into the future. However, this becomes clear:

Long-term development is inextricably linked to technological and political unknowns.

Influencing factors with high uncertainty:

-

Technological efficiency gains in mining (e.g. new chip generations, cooling, choice of location, quantum computers)

-

Political intervention in energy policy or Bitcoin use

-

Change in the energy cost structure (peak energy, new sources, free energy)

- Changes to the mining infrastructure (e.g. new pools, geographical relocation, state-subsidized mining)

Therefore:

The further into the future the forecast extends,

→ the more it should be understood as a dynamic range with a growing bandwidth

→ and not as a deterministic final price.

Nevertheless, it is not speculative, but can be logically derived from the Bitcoin protocol and the energy economy - as long as no disruptive interventions or upheavals occur.

Other typical subjective benefits of Bitcoin

In order to answer the usual question "Which fundamental factors support the value of Bitcoin?" beyond the objective price floor, the following points show examples of the subjectively perceived benefits of Bitcoin from the perspective of market participants - a benefit that can be directly reflected in willingness to pay and price:

-

🌍 Cross-border availability - accessible worldwide, regardless of national borders

-

🧮 Limited supply - maximum quantity of 21 million BTC = digital scarcity

-

💸 Protection against inflation - no devaluation due to expansion of the money supply

-

🏦 Independence from the banking system - full control over your own assets

-

🚫 Censorship resistance - no central authority can prevent transactions

-

🔁 Mobility of assets - globally recoverable via seed word

-

🕵️♂️ Pseudonymity - no obligation to disclose identity

-

📜 Trust in code - mathematically verified rules instead of politics

-

🛡 Hedging against geopolitical risks - capital flight without physical takeover

-

🪙 Long-term store of value - digital equivalent of gold

-

🧠 Transparent monetary policy - all rules are public and unchangeable

-

💧 High liquidity - easy exchangeability into fiat currencies

-

📆 24/7 tradability - no stock exchange opening hours

-

🏪 Acceptance by companies - e.g. as a means of payment

-

📱 Low entry barriers - easy access via app or hardware wallet

-

🏰 Security through decentralization - no central attack surface

-

🏛 Reputation as "digital gold" - growing trust among institutions

-

🌐 Access to global markets - independent of local restrictions

-

📈 Long-term appreciation potential - expectation of future price increases

Conclusion

The subjective theory of value explains why Bitcoin is often traded well above the objective lower price limit. The higher the perceived benefit, the higher the willingness to pay - and therefore the price.

In early market phases, this uncertainty was reflected in high volatility. However, as the network matures and adaptation increases, this effect becomes measurably smaller.

In the long term, pricing will move closer to the objective fundamentals - in particular the energy-based production costs and the mathematically fixed supply structure.

4.1 The value of Bitcoin is backed by energy - energy use as a security mechanism and simultaneous price driver

Bitcoin is not a symbolic or purely trust-based store of value.

Its production process requires a real economic input - specifically: energy.

Every single Bitcoin is the result of a physically measurable effort,

→ in particular the power consumption of the mining hardware.

This effort is:

-

non-negotiable

-

cannot be manipulated by political decision

-

and an integral part of the Bitcoin system architecture.

Differentiation from fiat currencies

In contrast to fiat currencies, whose money supply can be expanded at will for political reasons,

Bitcoin is tied to a scarce, energy-intensive production factor.

This energy-economic coupling creates a physically founded value basis - independent of trust, promises or institutions.

Fiat money, on the other hand, does not derive its value from real economic expenditure, but from a monopoly of use enforced by state power:

-

Taxes must be paid in fiat.

-

Raw materials are (mostly) still invoiced in US dollars.

-

Debts and contracts are legally tied to the national currency.

- In addition, fiat money is a debt and interest-based system in which new money is created by granting loans - the repayment of these loans, however, requires interest payments for which there is no explicit cover in the original money creation process. This creates a structural growth constraint and a latent shortage of means of payment.

This forced demand is maintained by the state's monopoly on the use of force. The value of fiat money is therefore not created through production, but through coercion to use it - a structurally different form of value creation.

→ Bitcoin is not only secured by energy, but can also be objectively valued by it. Fiat money, on the other hand, is backed by political power and institutional coercion - not by energy or effort.

4.2 Misconceptions in the public debate about Bitcoin

Misunderstanding: The price of Bitcoin only depends on whether the next buyer pays more than the previous one.

This misunderstanding stems from an ignorant reduction of the complex mechanisms behind price formation. As shown in the previous section, the Bitcoin price is made up of two components: the production costs as the lower price limit and the subjective benefit as the price-driving factor. Bitcoin is therefore not purely an object of speculation, but - like any other scarce commodity - is subject to an economically comprehensible tension between cost and demand.

Misunderstanding: Bitcoin is a Ponzi scheme.

A Ponzi scheme is defined by the fact that there is a central intermediary who collects the money of new participants, makes promises of high returns and finances the payouts to previous investors from the contributions of the new ones - while enriching himself. The Bitcoin system has no such middleman. There is no central authority that controls the distribution of money or skims off profits. Miners receive their rewards according to a publicly accessible protocol that applies equally to everyone and are an integral part of the automated incentive structure that keeps the network alive. The block rewards are not generated by deposits from new participants, but by the algorithm - in conjunction with an open, competitive computational effort. Bitcoin therefore does not fulfill the criteria of a Ponzi scheme.

Misunderstanding: Bitcoin is a pyramid scheme.

A pyramid system is based on the fact that existing participants have to recruit new ones so that they in turn pay in and pay out the previous ones. The system collapses as soon as no more new participants join. Some pay-as-you-go systems for pensions, for example, work according to this principle. Bitcoin, on the other hand, continues to function even if no new participants are added - as long as users continue to see the benefits of the network and are willing to pay for Bitcoin. There is no obligation to attract new users in order to maintain the system with promised payouts. The scarcity and structure of the system remain, regardless of the number of participants. Bitcoin is therefore not a pyramid scheme.

Published: 16.4.2025